Which is a benefit of using payment apps and online payment services?

Convenience: Mobile payments allow users to make transactions quickly and conveniently using their smartphones or other mobile devices. With mobile payment apps installed on their devices, users can make payments anytime, anywhere, without the need to carry cash or physical credit cards.

- Impulse to buy. Customers can pay as soon as they feel the impulse to buy. ...

- Security and credibility. ...

- Cost of currency conversion. ...

- Encouraged to upgrade purchases. ...

- Money is available quicker. ...

- The cost. ...

- High level of consumer protection. ...

- Entities that operate cards.

Speed of transactions

For both the seller and the customer, online payments save a lot of time. People don't have to wait in lines, take time to write checks, or wait for paper bills. They don't have to wait for banks to clear their checks so that they can access the money.

Mobile payments can be convenient, fast and secure. They can, however, be expensive and still vulnerable to issues with technology. In particular, if there are any issues with the host phone, mobile payments will be unable to work at all.

In summary, Payment Service Providers can help you reduce integration and processing costs, accept multiple payment methods and currencies, and safely and securely facilitate your payments.

- Paytm.

- Google Pay.

- PhonePe.

- CRED.

- MobiKwik.

- PayPal.

- Payoneer.

- Wise.

In conclusion, virtual payments offer many advantages, including convenience, security, and reduced costs. However, there are several disadvantages to consider, such as technical issues, security risks, and limited consumer protection.

Answer. E-Banking offers discounts, convenience, speed, transferring services and the management of the funds, 24*7 facilities and the liquidity of the funds to its customers. Answer. It provides quick services because individuals do not have to wait in lines to pay their bills or transfer payments.

Disadvantages of Electronic Payment System

Unauthorized transactions, stolen credentials, or fraudulent activities can occur, leading to financial losses for individuals and businesses. Privacy Concerns: Users may be concerned about the collection and storage of personal information by electronic payment providers.

While there are many benefits to using mobile payment apps, one of the main disadvantages is their limited acceptance. Although these apps are gaining popularity, not all merchants accept mobile payments. This means that you may still need to carry physical cards or cash as a backup.

What is the benefit of a transaction account?

Benefits of a transaction account

Transaction accounts come with several benefits: Link a debit card to your transaction account. You can then use that debit card to pay for goods and services in-store and online, as well as withdraw cash from ATMs.

Cash is not subject to security breaches like digital payments are since there is no system to breach. However, physical money can be stolen, even though there is no risk of sensitive details being stolen if that happens.

They are more convenient than carrying cash or cards. They are faster than traditional methods like point-of-sale terminals or cheques. They are more secure than cash, as they can be PIN-protected and use tokenization.

Faster way to pay

This results in a contactless, yet secure transaction since your card number is never revealed. Plus, this process is often faster than inserting or swiping your physical card. Contact your wireless carrier, as data charges may apply if you're using mobile pay.

Mobile apps offer better personalization

Mobile apps can let users set up their preferences at the start, based on which users can get served with customized content. Apps can also track customer engagement and then utilize it to offer custom recommendations and updates to the users.

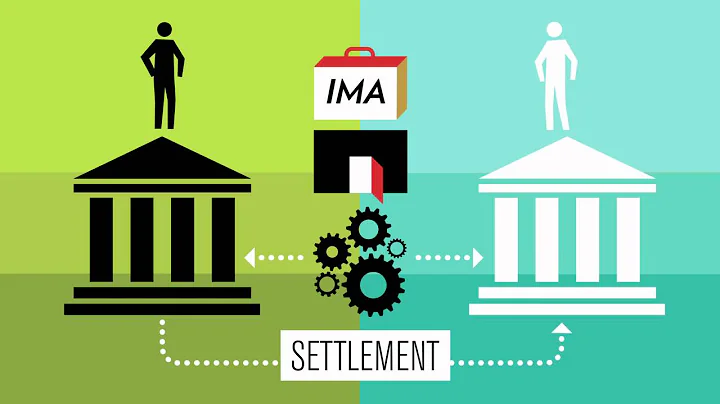

Payment service includes services provided to users (customers) and transactions related to fund transfers realized with or without payment accounts within the payment service provider itself or in another payment service provider.

- Authorize.net: Best for fraud prevention.

- Stax: Best for high-value transaction.

- Payline Data: Best for subscription-based businesses.

- Shopify: Best for ecommerce startups.

- Helcim: Best for high-volume sellers.

- Elavon: Best for integrating with existing point-of-sale (POS) systems.

A payment processor may label a merchant account as high-risk if they've determined your business account is at higher risk for chargebacks, fraud or a high volume of returns. The greater the risk, the harder it will be to find a traditional bank or payment processing service provider.

- Google Pay. Best for Android Users. Jump To Details. ...

- Cash App. Best for Buying Stocks and Bitcoin. ...

- PayPal. Best for Shopping Online. ...

- Zelle. Best for Instant Bank-to-Bank Transfers. ...

- Apple Pay. Best for Purchases iOS and Mac Users. ...

- Samsung Pay. Best for Contactless in-Store Purchases. ...

- Venmo. Best for Paying Friends.

- PayPal. Safe and secure.

- Credit card. Well protected against fraudulent transactions.

- Debit card. Great for controlling your spending.

- Prepaid card. Provides a certain level of privacy.

- Digital wallets. ...

- Mobile payment apps. ...

- Cryptocurrencies.

What is the best app to accept payments?

| Product | Best for▼ | Monthly fee▼ |

|---|---|---|

| Stripe Learn more on Stripe Payments' secure website | 5.0/5 Best for Online-first businesses | $0.00 |

| QuickBooks GoPayment Read Review | 4.5/5 Best for Invoicing | $0.00 |

| Venmo Business Account | 4.0/5 Best for Accepting payments with a QR code | $0.00 |

It is a fantastic technique to boost sales. Your money and other financial information are simpler to handle and store when you use online payments. There are several tools on the internet that may assist with transactions for both consumers and sellers.

The 5 most important banking services are checking and savings accounts, loan and mortgage services, wealth management, providing Credit and Debit Cards, Overdraft services. You can read about the Types of Banks in India – Category and Functions of Banks in India in the given link.

Due to the open nature of the Internet, all web-based services such as YAB's Online Banking are inherently subject to risks such as online theft of your User ID/UserName, Password, virus attacks, hacking, unauthorized access and fraudulent transactions.

- Monthly maintenance/service fee. This is a fee that banks charge to cover the cost of maintaining your account each month. ...

- Out-of-network ATM fees. ...

- Overdraft fees. ...

- Insufficient funds fees. ...

- Paper statement fees. ...

- Wire transfer fees. ...

- Account closing fees. ...

- Dormancy fees.